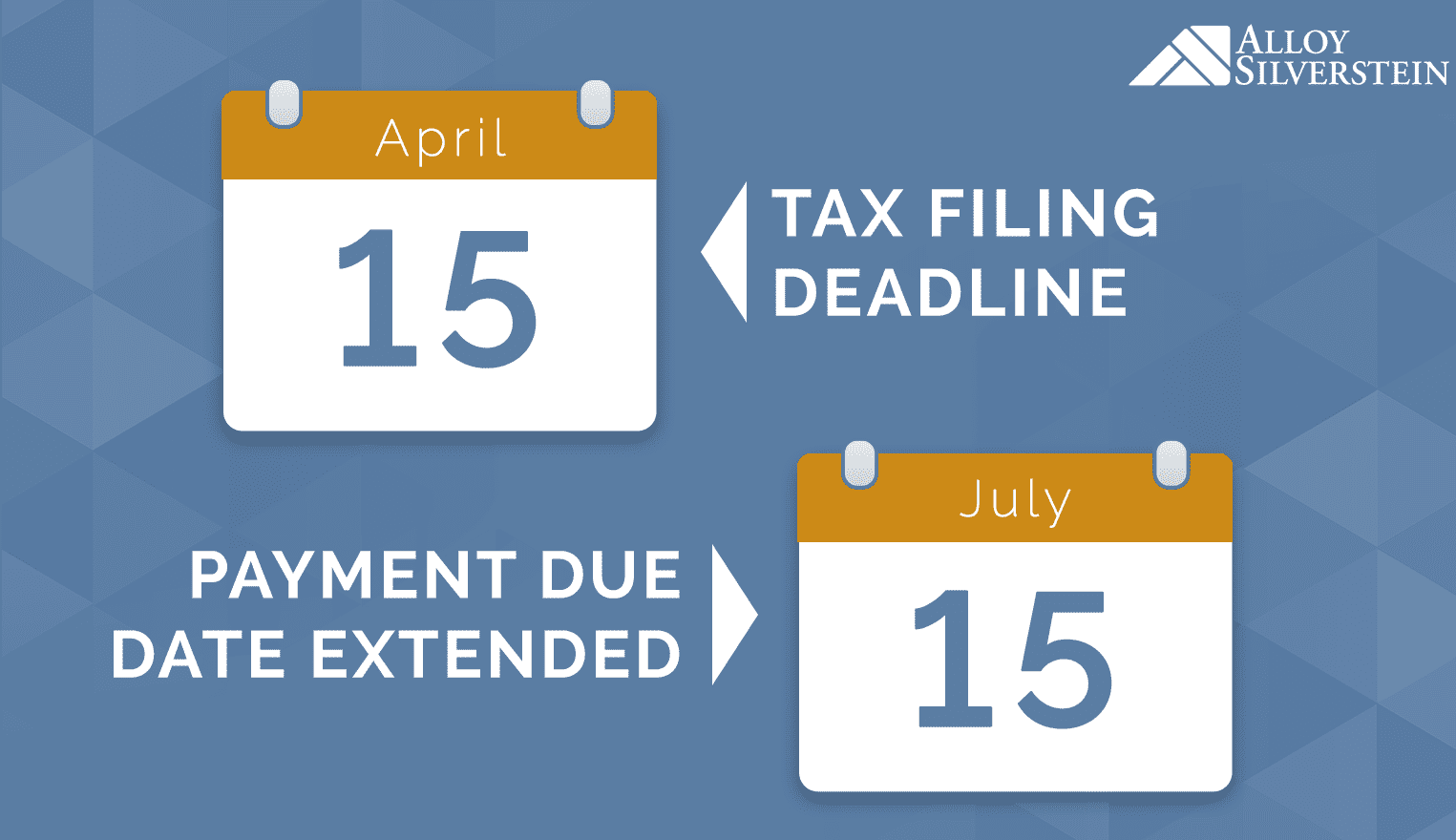

UPDATE: On Friday, March 20, 2020, Treasury Secretary Mnuchin announced that the April 15 tax filing deadline is officially being postponed to July 15, 2020.

The Coronavirus continues to impact the daily lives of millions of Americans, including their taxes. On March 17, The U.S. Treasury announced relief measures to try to aid individual and business taxpayers during these trying times. However, until the IRS released additional guidance, there has been some confusion on what is due and when.

The 2019 federal filing deadline for individuals and C-corporations has not been extended and remains April 15, 2020. The IRS and Treasury encourage taxpayers to file their tax returns as soon as possible, especially if you are expecting a refund. Alloy Silverstein’s accountants and advisors continue to be operational so clients can meet this deadline.

In response to taxpayers affected by the Coronavirus, the due date for making federal tax payments due on April 15, 2020 has been extended 90 days to July 15, 2020 for individuals owing less than $1,000,000 and businesses owing less than $10,000,000. This applies to amounts due on 2019 tax returns as well as first quarter 2020 estimated payments.

Keep in mind that second quarter 2020 estimated tax payments are scheduled to be due on June 15, 2020 and no changes have been announced at this time.

Note that this postponement on payments applies only to federal returns. Check with your state’s tax deadlines and COVID-19 guidance to see if there are any changes to the state due dates. The AICPA has provided this PDF chart to keep taxpayers updated on individual states’ filing relief.

Since government announcements and updates are announced daily, the situation is constantly evolving. We will keep you updated with any further changes and extensions.

Alloy Silverstein’s team is here to to help you prepare, plan, and file your taxes on time. For a virtual meeting this tax season, fill out our contact form.

Empowering business owners and individuals in South Jersey and Philadelphia to feel confident through proactive accounting and advisory solutions.