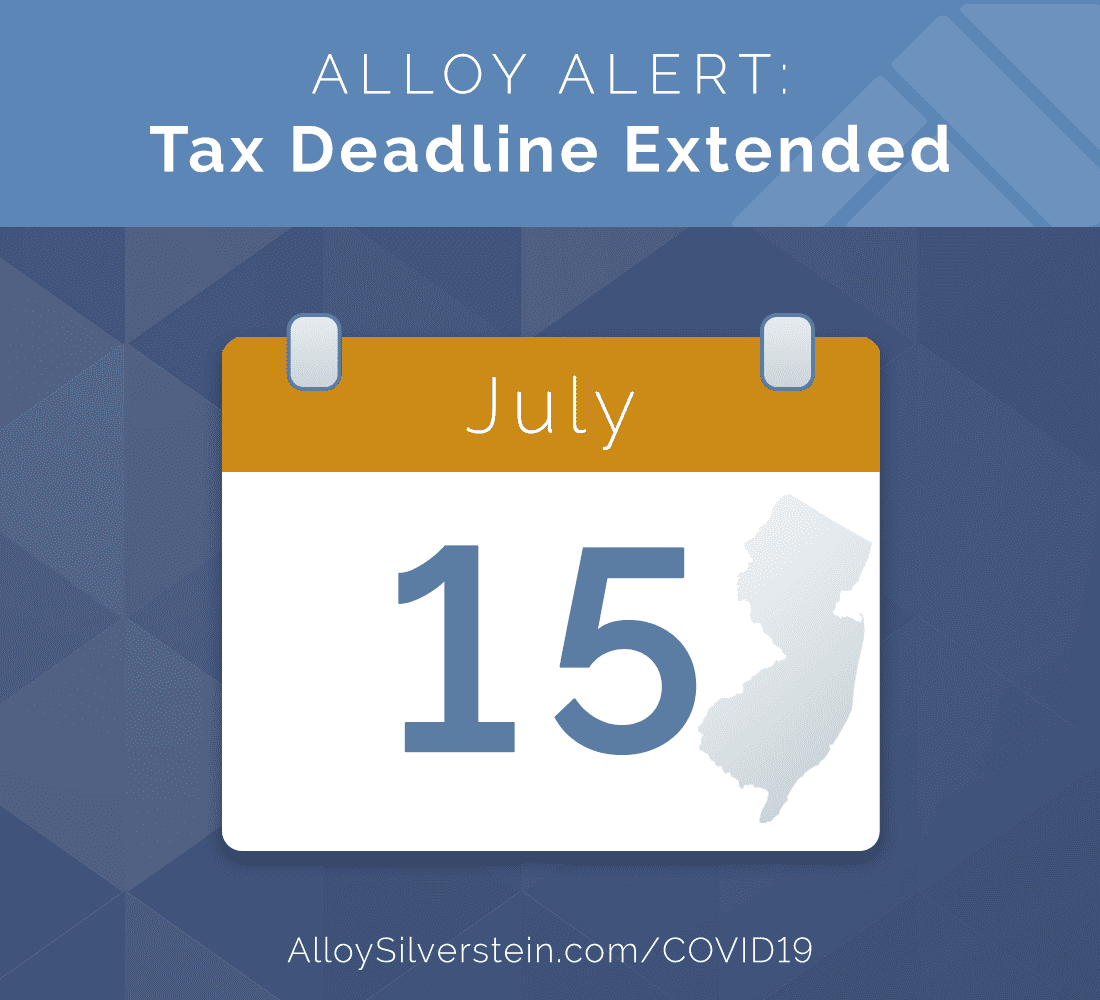

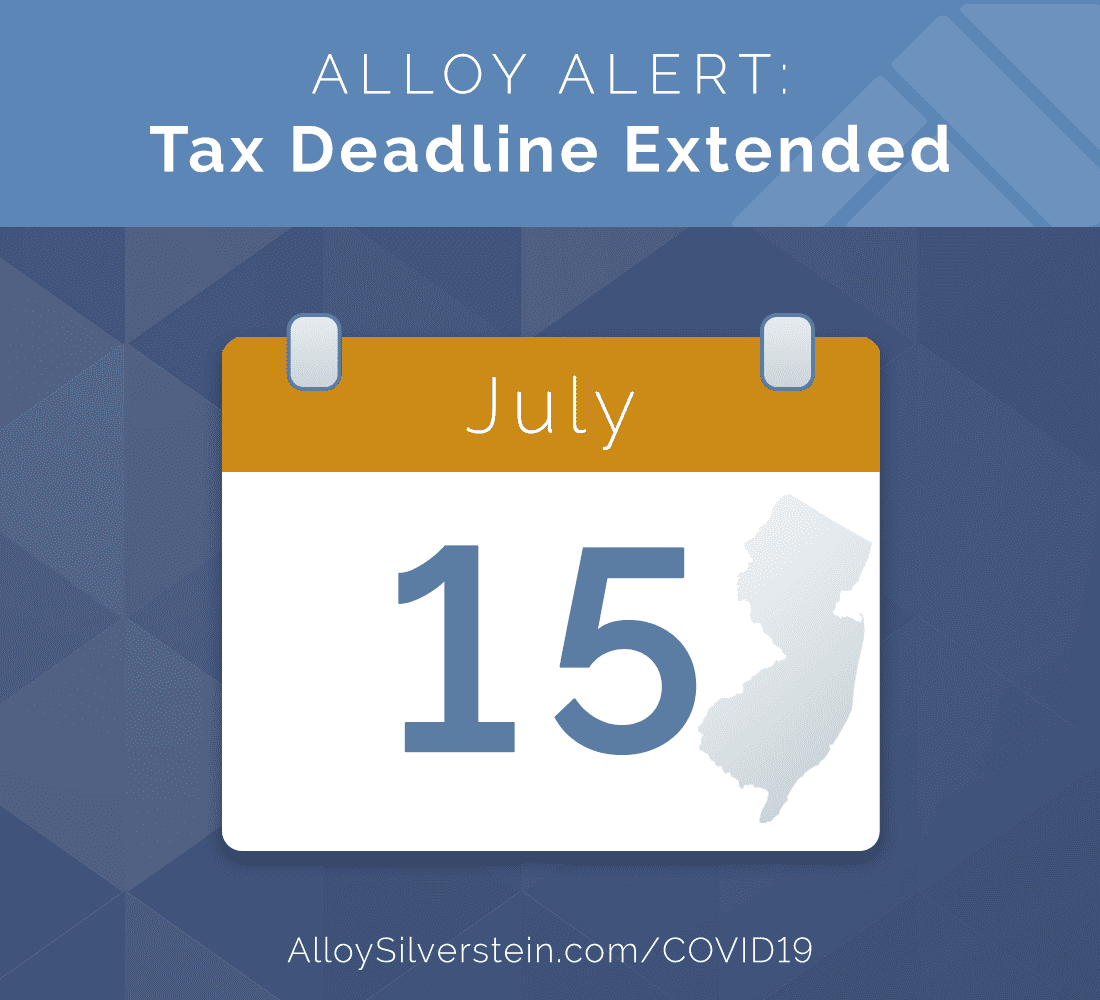

On April 1, 2020, New Jersey Governor Murphy, Senate President Sweeney, and Assembly Speaker Coughlin finally announced that the New Jersey state income tax filing deadline and corporation business tax filing deadline will be extended to July 15, 2020. This now coordinates with the IRS federal tax filing extension, as well.

In addition, the state’s budget will be extended to September 30, 2020.

New Jersey joins neighboring states Pennsylvania, Delaware, and New York that have previously announced a new state filing deadline of July 15. For the full list of state tax updates due to the Coronavirus pandemic, this AICPA is maintaining this PDF chart.

As this is a breaking news post, more details will be added as they become available.

BREAKING: The New Jersey state tax filing deadline WILL BE EXTENDED from April 15th to July 15th.

Additionally, the state fiscal year will be extended to September 30th to allow us to focus on leading our state out of this crisis.

Thank you, @SpeakerCoughlin and @NJSenatePres. pic.twitter.com/kQFgsBKDHA

— Governor Phil Murphy (@GovMurphy) April 1, 2020

Stay informed of the latest COVID-19 information in our COVID-19 Resource Center. Contact an Alloy Silverstein accountant and advisor for further tax or business assistance.

Empowering business owners and individuals in South Jersey and Philadelphia to feel confident through proactive accounting and advisory solutions.