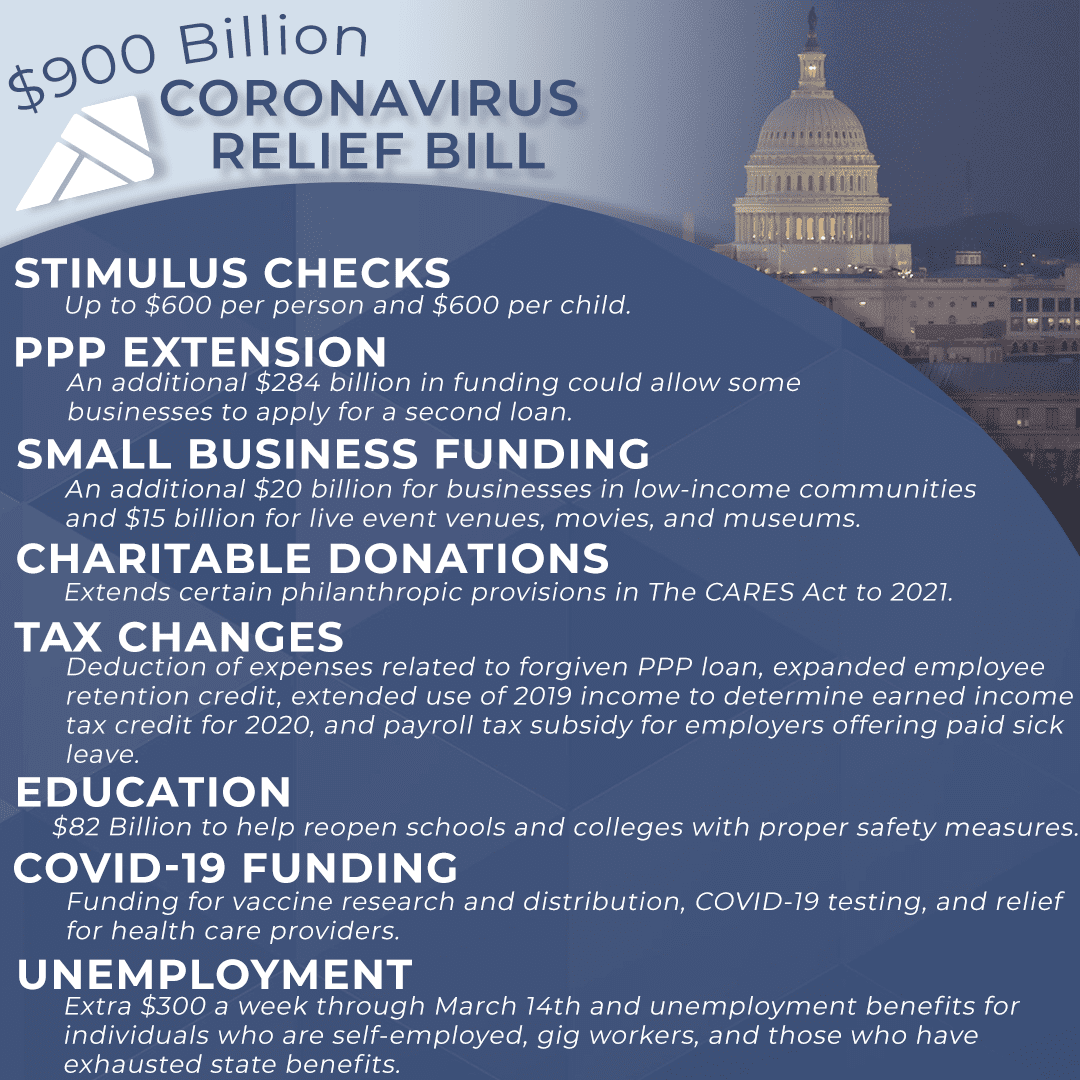

President Trump has signed the Consolidated Appropriations Act, 2021 which includes $900 billion of funding. This new bill will provide more stimulus money to individuals, additional PPP loan money for small businesses, funding towards the COVID-19 vaccine, and more. We break down what the bill entails and where the funding will be allocated.

$284 billion will be allocated to additional Paycheck Protection Program loans. Some businesses may be able to apply for a second PPP loan. Additionally, $20 billion will be designated to EIDL advances of up to $10,000 for businesses in low-income communities. In order to aid businesses that have been hit substantially by the pandemic, $15 billion will go toward SBA grants up to $10 million for live event venues, museums, and movie theaters.

Back in March 2020, The CARES Act passed several provisions that benefited philanthropic donors. The new legislation extends these provisions in three key areas. First, cash contributions to public charities in 2021 is increased to 100% of adjusted gross income. Also, for non-itemizers, joint filers can deduct a maximum of $600 in cash gifts made to public charities, although this does not reduce adjusted gross income. Taxpayers who file as single or married filing separately remain limited to $300. Lastly, the 25% taxable income limit for corporate cash and food inventory donations has been extended into 2021.

Businesses will be able to deduct expenses related to their Paycheck Protection Program loan forgiveness. Also, in order to promote hiring and retention of employees, the employee retention credit and work opportunity tax credit will be extended. Employers offering paid sick leave to employees can take advantage of a payroll tax subsidy.

Eligible families will be permitted to use their 2019 income to determine their earned income tax credit for the 2020 tax year.

The stimulus bill provides an additional $300 a week to those who qualify for unemployment assistance from now until March 14, 2021. It also grants unemployment benefits for those who are self-employed, gig workers, and those who have depleted their state benefits.

There will be an additional stimulus payment of $600 per individual, $1,200 per couple, and $600 per qualifying child. This additional stimulus money will be available for individuals with adjusted gross income of $75,000 or less, and couples with AGI of $150,000 or less. The IRS will be using the same method to calculate stimulus payments as it did in the first round. Therefore, if you received a stimulus check the first time, you should expect another one.

Additional funding, $82 million, has been allocated to the reopening of schools and colleges in order to implement safety protocols and limit transmission of the virus while safely reopening.

$68 Billion of the stimulus bill will be distributed between vaccine research and distribution, COVID-19 testing, and relief for health care providers.

Please contact your Alloy Silverstein accountant and advisor if you have any questions or concerns. You may also email solutions@alloysilverstein.com.

Empowering business owners and individuals in South Jersey and Philadelphia to feel confident through proactive accounting and advisory solutions.