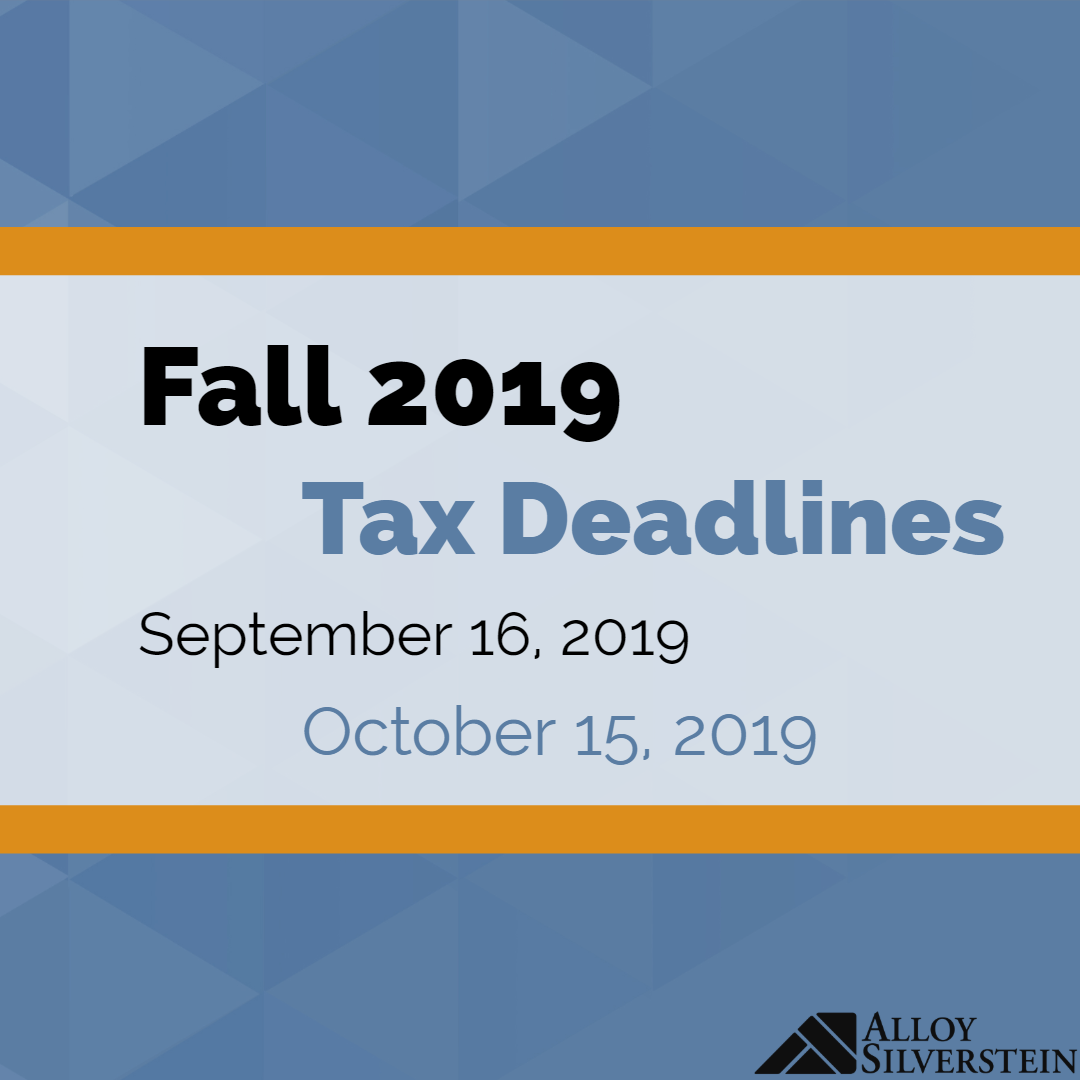

– Third quarter installment of 2019 individual estimated tax is due.

– Filing deadline for 2018 calendar-year tax returns for S corporations and partnerships with extensions of the March due date.

– Filing deadline for 2018 individual tax returns on automatic six-month extensions of the April due date.

– Deadline for filing 2018 calendar-year tax returns for C-corporations with extensions of the April due date.

– Estimate your 2019 income tax liability and review your options for minimizing your 2019 taxes. Call to schedule a tax planning review.

To protect taxpayers, the IRS has stopped faxing tax transcripts to both taxpayers and third parties. These summaries of tax return information were often used by criminals to file fraudulent returns in order to obtain refunds. Now, to get a tax transcript, individual taxpayers may use IRS.gov or the IRS2Go app to access “Get Transcript Online” or “Get Transcript by Mail.” They can also call 800-908-9946, or submit Form 4506-T or 4506T-EZ to have a transcript mailed to the address of record.

Effective August 12, 2019, if you make a contribution to a charity that is offset by a state or local tax credit, you must reduce your federal charitable contribution by the amount of the credit. For example, if you donate $1,000 to a charitable program and the state grants a 70% tax credit, you would receive a $700 credit and your federal tax deduction would be $300. There are some exceptions so be sure to ask your tax advisor for more details.

The interest rates on underpayments and overpayments are going down for the calendar quarter as of July 1, 2019. The rate will be 5 percent for all individuals and businesses except corporations. The rate on corporate overpayments will be 4 percent up to $10,000 and 2.5% thereafter. Large corporate underpayments will be charged a 7% interest rate.

This article was published in Alloy Silverstein’s Fall 2019 Newsletter. Click here for more content or to subscribe.

Empowering business owners and individuals in South Jersey and Philadelphia to feel confident through proactive accounting and advisory solutions.