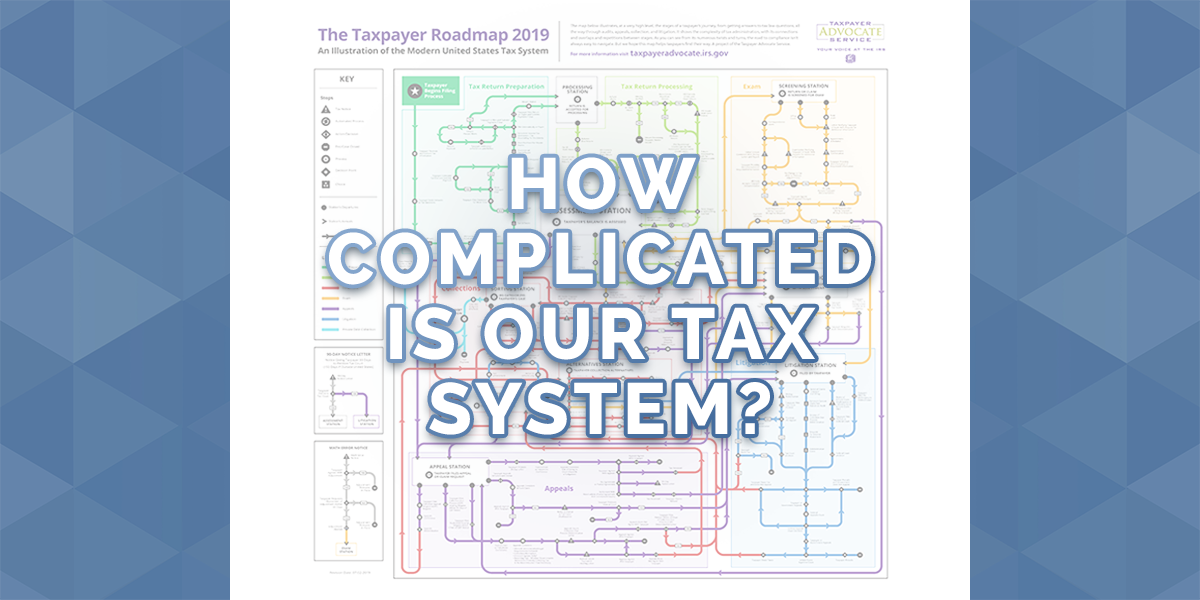

The short answer is “very complicated.” In an effort to depict the various processes and decisions that a taxpayer may face while filing and paying taxes, the IRS Taxpayer Advocate Service published a roadmap that resembles a large, complex subway system in a major city.

At first glance, the map looks so complicated that navigating our tax system seems almost impossible. Upon closer inspection, however, the map lists all the processes, decisions, and choices a taxpayer is faced with at various stages of the journey. For many taxpayers, the process is relatively simple. Once tax documents and information are gathered, a tax return is prepared by either the taxpayer himself or a tax professional. The return is filed, and any tax due is paid or any overpayment is refunded. As the map indicates, however, there are numerous possible twists and turns even within this portion of the system.

A taxpayer must understand the tax law and how it applies to him in order to file a complete and accurate tax return. With the recent, sweeping tax reform many of the rules have changed significantly. The IRS website https://www.irs.gov/ is an excellent place to start. All of the tax forms and instructions are posted, as well as articles on various topics. Although the IRS has a phone number, it can be difficult to get a real person on the line. Even if a call is answered, the agent will probably not be able to give an opinion about whether or not a particular rule applies to the caller’s individual situation. There are some physical “Taxpayer Assistance Centers,” but you must have an appointment in advance. Some taxpayers may not live near any of these centers, so this is not practical for many. Engaging a paid tax professional like a CPA is probably the easiest way to get answers, but obviously not without a cost. Taxpayers should also beware of taking tax advice from a generic internet search. Although there are numerous articles posted about virtually every part of the tax code, taxpayers should remember that no two sets of circumstances are identical. Even if a very knowledgeable and respected expert wrote an article about a topic, there may be small details and facts that are not fully described in the article and therefore would not apply to another taxpayer who has what sounds on the surface like a similar situation.

Some people absolutely panic at the thought of the IRS “coming after them.” It is very important to note that the IRS begins any inquiry or assessment with a mailed notice. Any phone calls or emails demanding immediate payment are not legitimate. Would-be fraudsters try to trick unsuspecting taxpayers by claiming to be from the IRS. The IRS will never make initial contact by email or phone. If you do get a written notice from the IRS, however, you should not ignore it. Sometimes the IRS is simply asking for additional information to support something on a tax return. Sometimes the IRS is informing a taxpayer about sources of income that were reported to the IRS by a third party but not included on the tax return filed. It is also possible that the IRS is mistaken and is asking for additional tax that should not be due. A well-written letter of explanation with appropriate evidence attached may clear up the problem. If you ignore the notice, and the subsequent notices that follow, you may find yourself in collections with the possibility of tax liens on your property.

There are many different options for a taxpayer who owes back taxes or who disagrees with an IRS position about a particular matter. There is tax court and an appeals process. For those that have trouble paying the tax owed, there are installment agreements and offers in compromise. Anyone trying to navigate these sections of the tax system should absolutely retain the services of a licensed tax professional. The Taxpayer Advocate Service is also there to help taxpayers get resolution when tax issues stall and are not easily resolved through the normal channels.

Our tax system is complicated. This is not merely a function of bureaucracy, however. Many of the layers of the system are designed to protect taxpayers and to make sure they are treated fairly. A taxpayer doesn’t need to understand the entire system, but he should know where to seek help.

Associate Partner

Julie has over 20 years of experience in public and private accounting, representing varied clientele including the medical, legal, and real estate industries and trusts.

View Julie's Bio →