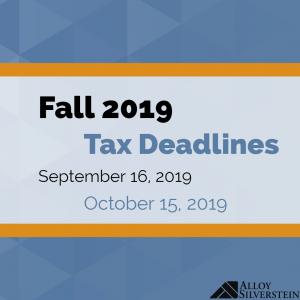

October 15, 2019

Increase Your Tax Refund with a Charitable Donation

If giving to charity is still in your agenda for 2019, there is still a window of time for you to make that year-end donation. Gifts to charity are one of the best tax-saving opportunities…

Read More...